Change language:

DK

EN

Only selected posts available in Danish

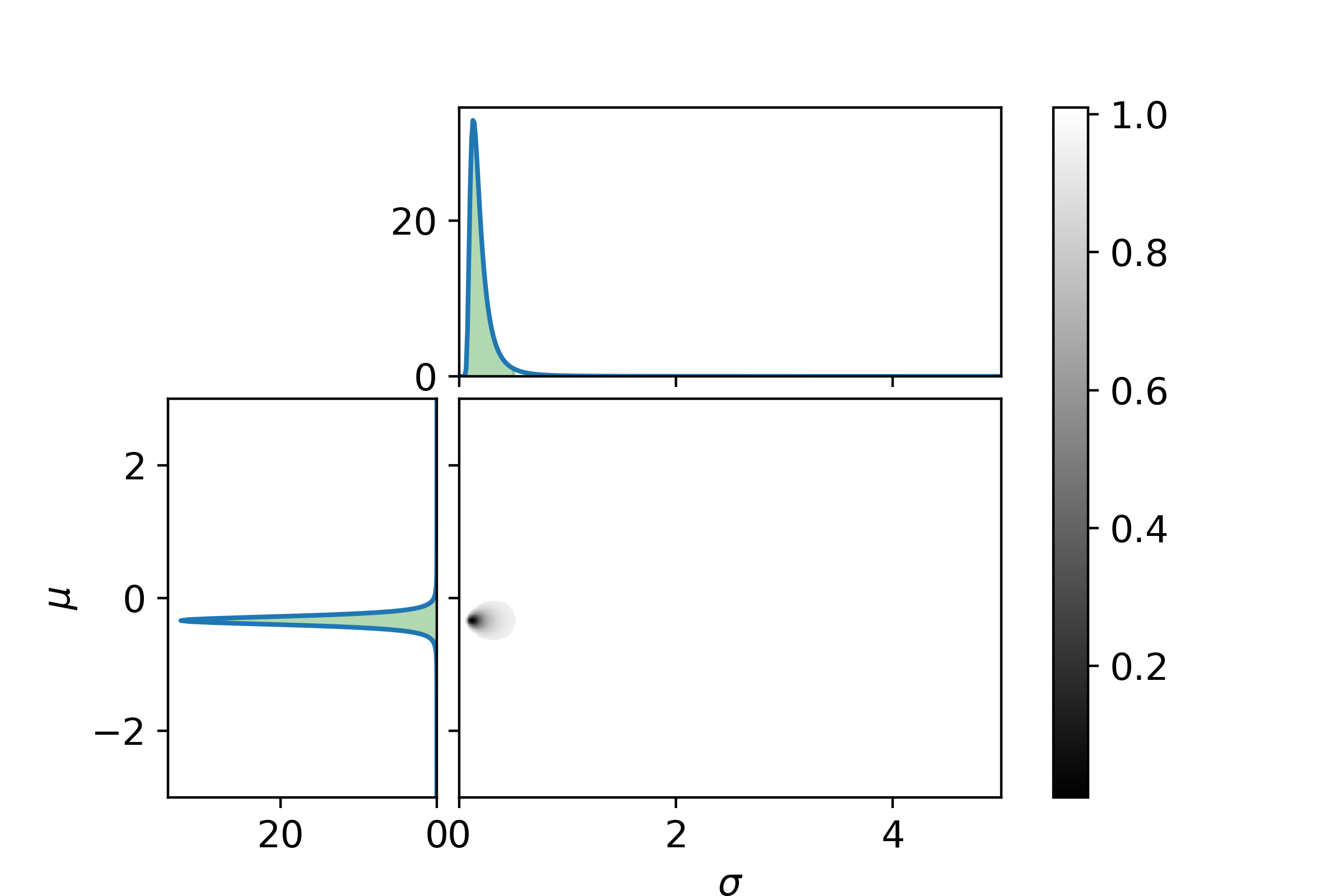

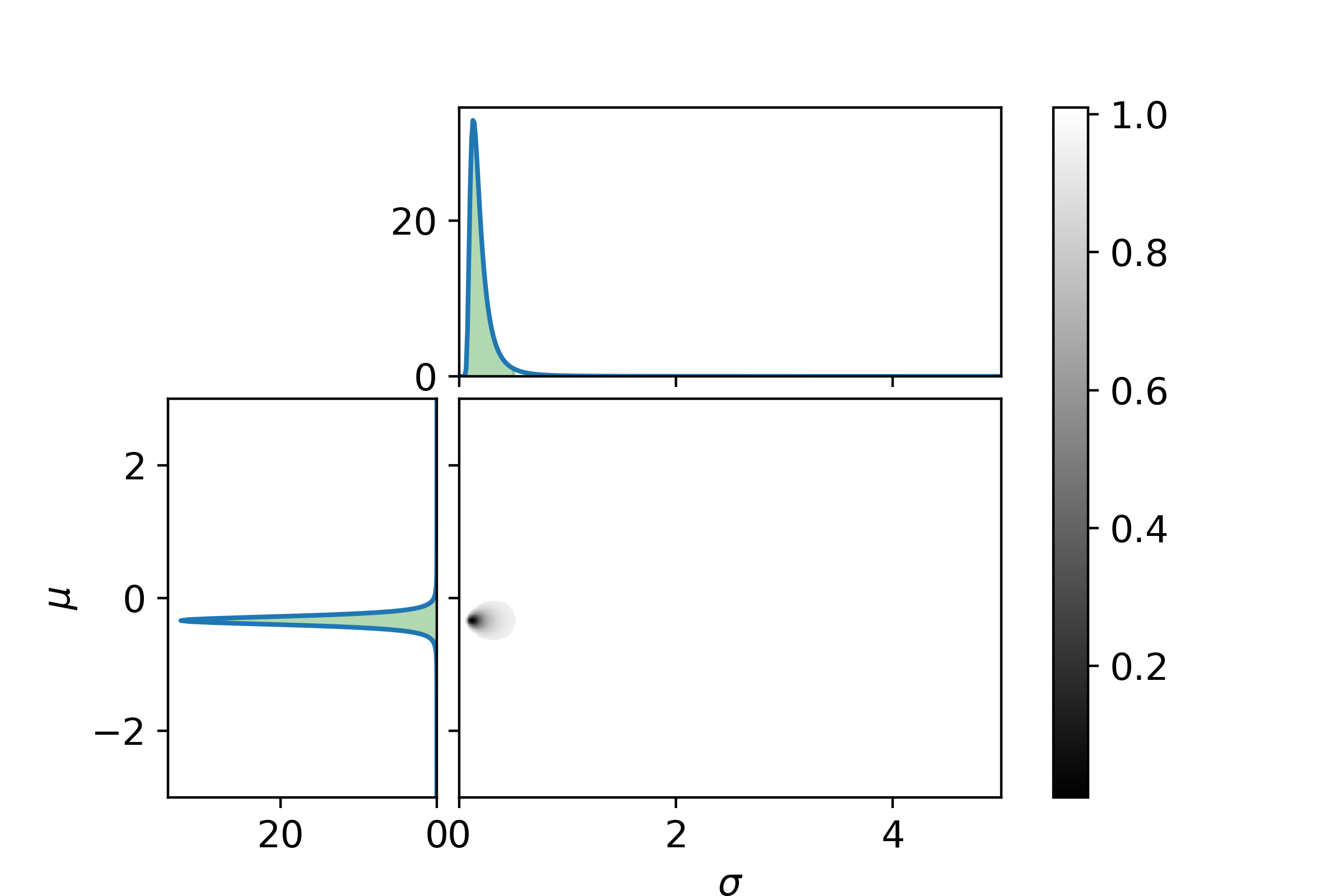

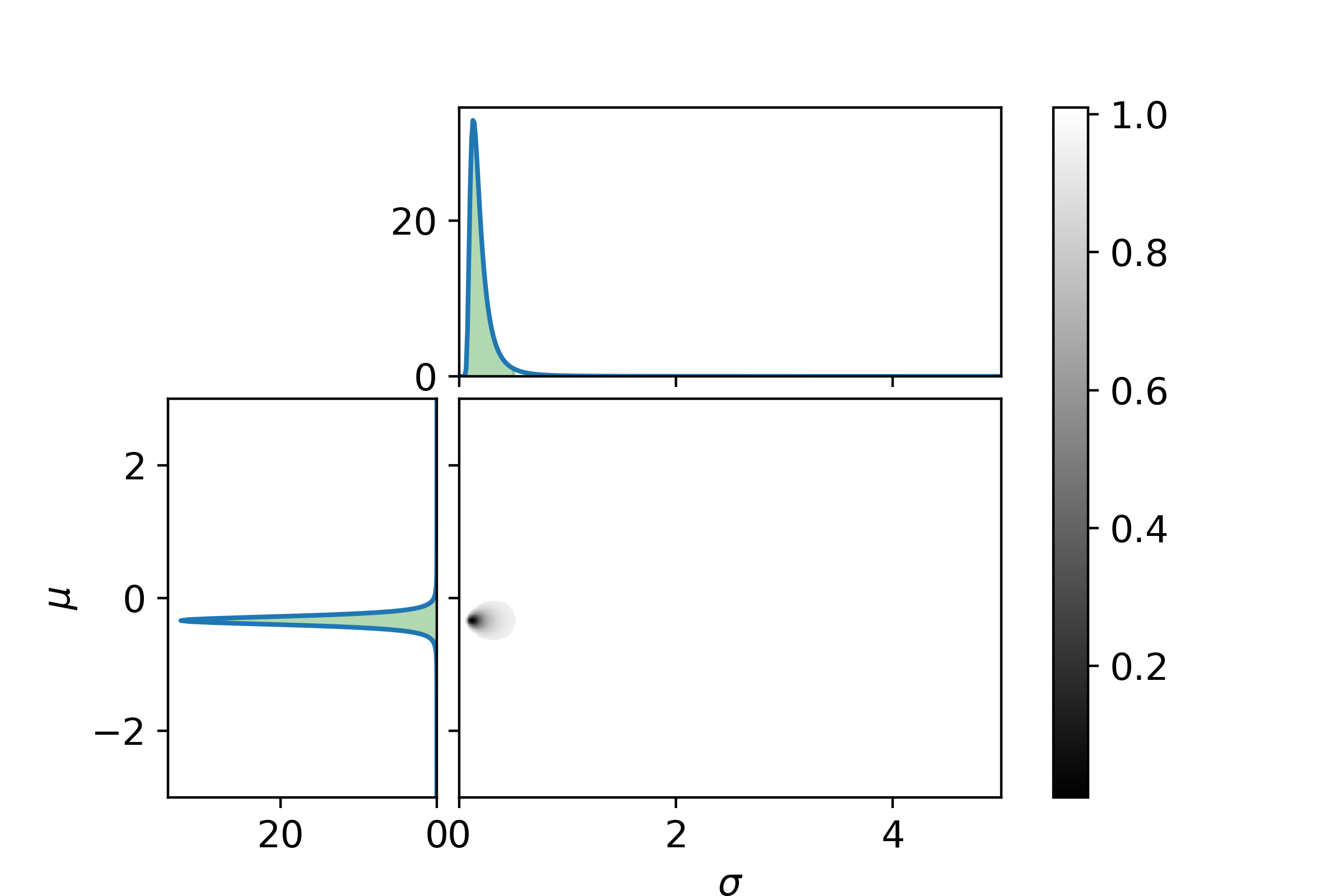

In the decision of which funds to invest in, an important parameter is how well the fund can track the benchmark index. It is to be expected that the variance of how well a specific fund can track an index...

In the United Kingdom investors can invest in a class of bonds known as premium bonds. Premium bonds does not have a fixed coupon-rate, but yield is instead distributed via. lottery. The prizes distributed as of May 2022 are: Prize...

Over the past 25 years the house prices have appreciated by a factor of ~3.5. But what drivers have been the primiary for this prise appreciation, and can this continue going forward? The primiary drivers for appreciation of house prices...

Given the selection of Danish investment funds from Sparindex and Danske Invest, it can be difficult to see how different the funds are. As a measure of similarity, one can calculate the overlap between two funds. The overlap between fund...

In Denmark, all ETFs are taxed yearly by unrealized returns. On the other hand, some Danish investment funds are taxed by realized gain, if they fulfill some criteria of paid out dividends. The dividend paid out will be: earned dividends...

Many brokers (at least in Denmark), have a pricing model of \(q\%\) of the trading amount or minimum \(q\) Euro. Given a fixed amount to invest every month, we might think it is best to accumulate the cash to reach...